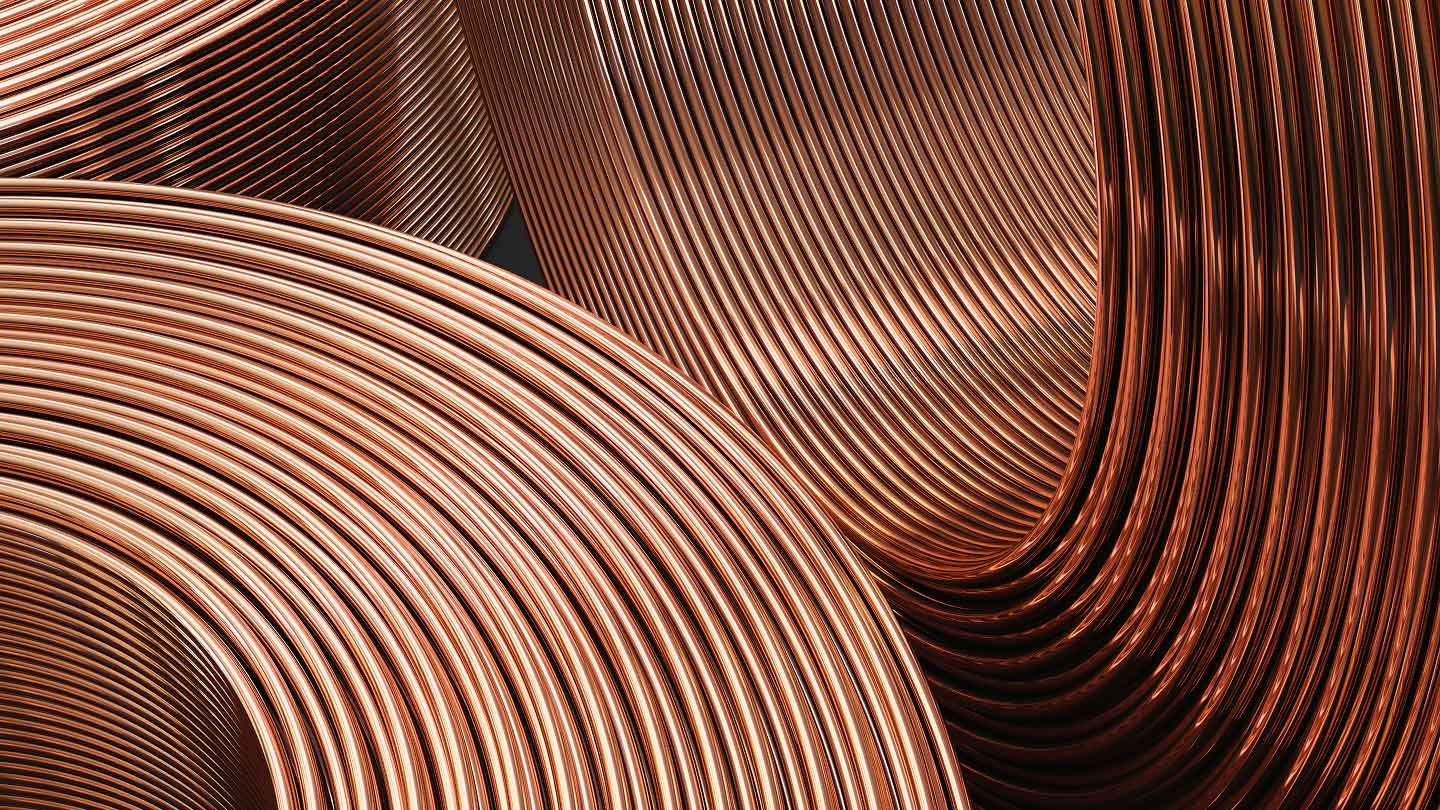

Ottawa, September 14, 2025 — The Europe Today: The Canadian government has announced the fast-tracking of key “nation-building” projects, including the development of two major copper mines, as global demand for the critical metal continues to surge. The announcement was made by Prime Minister Mark Carney on Thursday, who emphasized that such projects must enhance Canada’s autonomy, resilience, and security while delivering tangible benefits for Canadians.

The two initiatives include the McIlvenna Bay Foran Copper Mine Project in Saskatchewan and an expansion of the Red Chris Mine in northwestern British Columbia. Copper, the world’s third-most widely used metal, is vital for electrical infrastructure, electric vehicles, and green energy technologies. Its demand has soared due to the rapid growth of data centres, which power artificial intelligence and other digital technologies.

Vince Beiser, author of Power Metal: The Race for the Resources That Will Shape the Future, highlighted copper’s critical role: “All of our digital gadgets need electricity. How does electricity travel? How does it get from the dam or solar power farm to your home? It travels on copper.” Despite Canada’s mining capabilities, the country’s copper production and exports have lagged over the last decade, and even the accelerated projects may only partially address global supply challenges.

Strategic Importance and Global Context

The fast-tracking comes amid heightened geopolitical concerns. Copper prices spiked earlier this year amid U.S.-China trade tensions, with China dominating global refining and semi-finished product markets. Natural Resources Minister Tim Hodgson said Canada has a role to play “as a democratic country,” pointing to Beijing’s influence on global copper prices as a reason to boost domestic production. “We have an opportunity to take the cards out of autocrats’ hands and put those cards in Canada’s hand,” Hodgson noted.

However, Canada accounts for only about two per cent of global copper production, making it a relatively small player in the worldwide supply. Experts warn that while new projects are welcome, much of the projected global growth in copper production will occur outside Canada.

Industry Response

Canadian mining companies are increasingly prioritizing copper over other commodities. Barrick Mining recently sold its last gold mine in Canada to focus on copper, while Anglo American’s plan to acquire Teck Resources for its copper operations signals growing consolidation in the sector. Analysts note that the scarcity of shovel-ready projects underscores the supply challenges the industry faces.

Copper production in Canada has declined by more than 22 per cent between 2014 and 2023, with exports dropping roughly 24 per cent, according to federal data. While Chile remains the world’s largest producer at 30 per cent, experts suggest that Canada could potentially reach seven to eight per cent of global production over the next two decades if these projects are successfully implemented.

Prime Minister Carney and government officials view the fast-tracked copper projects as a strategic step toward strengthening Canada’s industrial base, national security, and role in the global green energy transition.